Washington Gas Light’s Migration from PowerTax to Tax Fixed Assets

Background

|

Washington Gas | ||

|---|---|---|

|

Location

Washington, D.C. |

Customers

1.2 Million |

Services

Natural Gas, Electricity, Green Power, Carbon Reduction, and Energy Services |

|

2023 Revenue

$253 million |

Founded

1848 |

Total Assets

$5.956 billion net PP&E |

For more than 20 years, WGL and PowerPlan have enjoyed a longstanding collaborative relationship built upon mutual respect and trust.

The strength of the relationship became evident in 2022 when WGL was able to draw upon the resources of PowerPlan to solve a myriad of issues.

Before transitioning to the new Tax Fixed Assets (TFA) solution, WGL had been using PowerTax since 2000,

consistently turning to PowerPlan for reliable support whenever tax changes occurred.

Overview

“I knew we had a problem and, as many times in the past, I knew we could rely upon PowerPlan to focus on our situation and find a solution,” shared WGL Tax Director Charles Mannix. “Once again, I was excited to partner with PowerPlan to develop an even better outcome for WGL.”

PowerPlan provided a co-sourcing arrangement to handle WGL’s immediate in-house resource limitations. At the same time, the two organizations worked to develop a strategy to address WGL’s needs in the future. This long-term plan included the implementation of PowerPlan’s Tax Fixed Assets (TFA) solution, with the goal of WGL reclaiming the tax depreciation and deferred tax function. The business case for adopting TFA was readily apparent and easily approved by management.

“We are really excited about the new product,” added Mannix. “The implementation of TFA was short, easy, and flawless due to the professional approach of our trusted vendor. Our staff enjoys the ease of use and looks forward to bringing the process back in-house.”

The Challenge

WGL’s tax department faced a typical no-win situation for any team: staff reductions, an upcoming heavy regulatory schedule, and the retirement of key personnel.

Their tax department staff was reduced by onethird. The team lacked a robust, in-house tax team to manage PowerTax. This posed a risk to data integrity, operational efficiency, and the organization’s overall financial health.

The scarcity of utility tax experts to join the team exacerbated an already difficult situation, leaving the tax team understaffed and lacking the necessary expertise to manage an upcoming regulatory schedule.

“I had seen a demo of TFA and was impressed. The regulatory calendar provided a clear and easily communicated business case to transition away from PowerTax to the cloud and TFA,” shared Mannix.

WGL needed a rapid, transformative solution allowing the internal tax team to take control of their tax operations, reduce reliance on external resources, and build a self-sufficient, knowledgeable, in-house team.

“I can’t stress enough how important the support of PowerPlan was to our immediate success in meeting our compliance, accounting, and regulatory requirements. Even more importantly, this support provided a concrete basis for the successful implementation of TFA.”

— Charles Mannix, Tax Director, WGL

Implementation

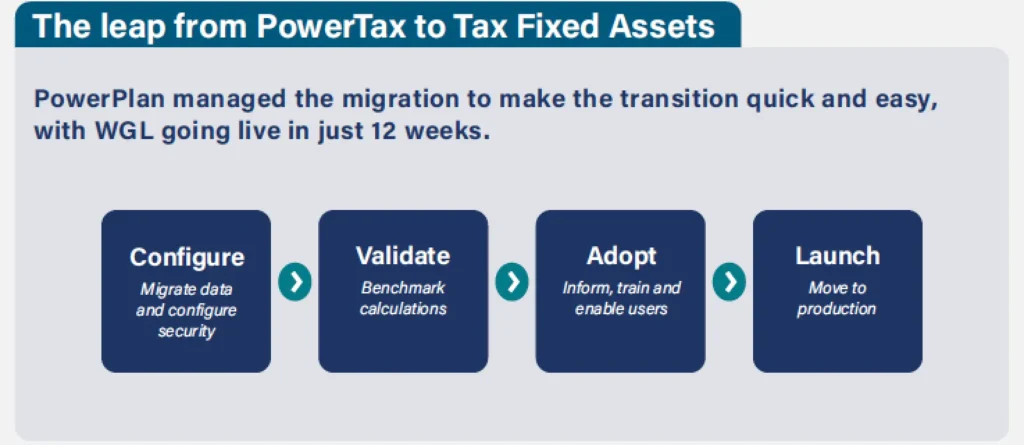

From the start, WGL and PowerPlan collaborated on implementing TFA. To meet WGL’s immediate needs, the PowerPlan services team stepped in to run tax operations in the absence of in-house resources. At the same time, the TFA implementation was meticulously planned and executed, focusing on minimizing disruptions to WGL’s operations.

“We worked with the WGL team from start to finish,” said Kinav Patel, Strategic Account Executive at PowerPlan. “In this case, we were already deeply connected to the tax team at WGL, and the migration to TFA was seamless with incredible trust on both sides.”

Key phases of the project included data migration, system configuration, user training, and testing. The PowerPlan team’s deep understanding of WGL’s specific requirements facilitated a seamless integration of TFA into the existing IT infrastructure. Much of the migration was handled by the PowerPlan team, with WGL minimally involved until the time came for data validation and system training.

PowerPlan’s Data Hub solution, part of the next-generation suite of connectivity solutions, enables seamless integration with WGL’s existing business intelligence solution. Data Hub also lays the foundation for future integrations to be easier as WGL’s strategy evolves with industry and technology changes.

“We needed to ensure certain solutions could be integrated, and PowerPlan worked to make it happen for us,” said Mannix.

PowerPlan Tax Fix Assets has centralized WGL’s tax processes and created real-time data insights like never before. With TFA, the team now operates with:

- Enhanced Efficiency: Automation of routine tasks, streamlined workflows, and the highly intuitive and easy-to-learn user interface have freed up valuable time for the tax team to focus on strategic initiatives.

- Improved Data Accuracy: TFA’s robust data validation and reconciliation capabilities have significantly reduced errors and inconsistencies, leading to increased confidence in tax reporting.

- Enhanced Decision Making: Real-time access to accurate and comprehensive tax data has enabled WGL to make informed and timely decisions.

- Reduced Cost: By automating processes and reducing manual effort, TFA has reduced overall costs to the enterprise.

- Mitigated Risk: TFA’s robust controls and audit trails have strengthened WGL’s compliance posture and reduced the risk of tax-related penalties.

We have a much stronger solution for our tax function now,” said Mannix. “ Because we have an easy touse, fully functioning system, we can focus more on tax strategy and less on blocking and tackling. The power of reconciliations in TFA is an underappreciated aspect of this new tool. Everything is validated in real-time while we work, and this has helped more than I could have realized.”

Upon implementation, PowerPlan’s services team has continued to support WGL through its tax operations. “We expect tax rate changes in the next 12 months, and with TFA, we’re more than prepared to handle that challenge,” said Mannix.

By using PowerPlan’s Data Hub solution, WGL has taken its data analysis to the next level. Data Hub makes it easy for the tax team to get the data they need for reporting and analysis, including integrating with their existing BI solution.

“It took me longer to buy TFA than to implement it.”

Charles Mannix, Tax Director, WGL

The Solution

WGL has partnered with PowerPlan since 2000 with a consistent history of turning to PowerPlan for solutions when needed. The partnership has been instrumental in transforming WGL’s tax team, and TFA was no exception.

The transition from PowerTax to Tax Fixed Assets with Data Hub allowed WGL to achieve significant improvements in efficiency, accuracy, and control. The intuitive platform has empowered the tax team to become a strategic business partner, providing valuable insights to support informed decisionmaking.

The transition to TFA also proved to be costeffective, saving money over a five-year period as it eliminated the need for PowerTax upgrades and extensive external support.

“TFA has been a game changer for my team. It has helped us build trust across our entire organization, not just in tax, but in plant accounting and beyond. We have access to better data because our team now understands where the numbers are coming from. Our audit fees have gone down, and our internal team is freed up to look around the corner to see what’s coming down the pipeline,” said Mannix. “TFA literally gives you the data you need at your fingertips.”

As WGL continues to navigate the evolving tax landscape, PowerPlan will remain a cornerstone of its tax operations, enabling the company to adapt to new challenges and opportunities. WGL’s experience serves as a blueprint for other organizations seeking to optimize their tax operations and unlock new opportunities.

WGL is prepared for future corporate rate changes.

Learn more about Tax Fixed Assets and request a demo at Tax Fixed Assets.

Share

About

WGL is a diversified energy business that provides natural gas, electricity, green power, carbon reduction, and energy services. Its family of companies includes Washington Gas, WGL Energy, and Hampshire Gas.