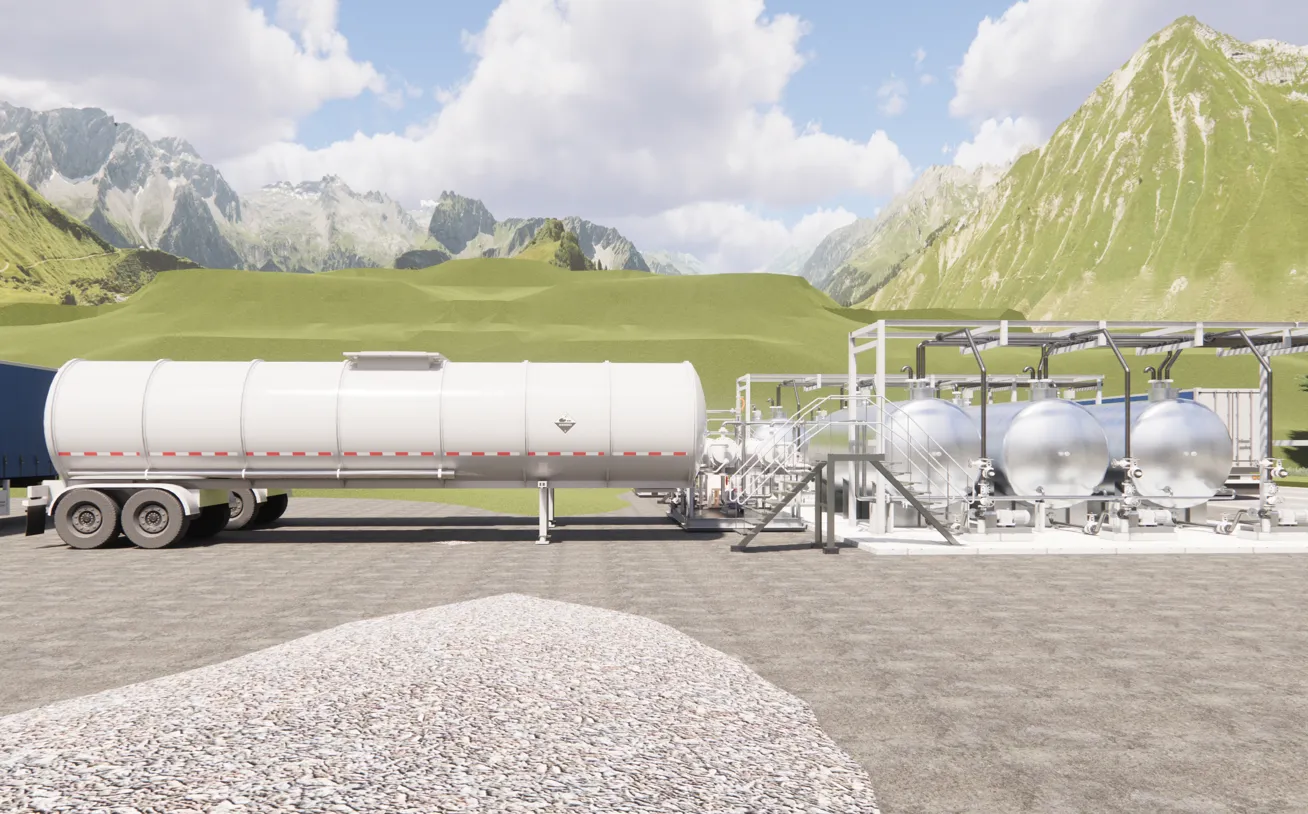

Transportation

Act on Real‑Time Financial Insight Across Transportation Assets

Gain the clarity and asset visibility needed to optimize tax positions and improve financial performance across transportation operations.

200+ Asset Intensive Customers Trust PowerPlan

Make Confident Financial Decisions Across Transportation Assets

Transportation companies face increasing pressure from evolving energy and environmental regulations, ongoing infrastructure investment demands, and rising expectations for financial performance. As you manage day‑to‑day operations, you also need to plan for long‑term sustainability—often across complex portfolios of owned and leased assets.

Meeting these demands requires more than compliance. You need real‑time visibility into your asset base and a clear understanding of the financial impact behind every decision. With the right insight, you can balance current operational performance with future‑focused capital planning and tax strategy.

PowerPlan gives you consolidated, asset‑level visibility across owned and leased equipment—so you can track critical data in real time, optimize tax positions, capture available incentives, and confidently manage financial performance as your transportation organization evolves.

Manage Multiple Tax Jurisdictions

Because transportation assets are geographically dispersed across multiple state and local jurisdictions, companies need to track assets in accordance with all relevant tax laws. PowerPlan’s ability to define all costs associated with an asset helps ensure exempt items are not inadvertently taxed and that valuations are accurately calculated.

Track Long-Term Service Agreements

Released in 2014, the IRS’s final tangible property regulations establish detailed rules as to what constitutes a deductible expense versus a capital improvement. These regulations require more diligent accounting of costs related to repairs, including those within complex long-term service agreements. PowerPlan allows companies to track these details, helping ensuring the appropriate tax calculations no matter the types of service contract.

Manage Project Costs

Transportation companies manage a range of large and small projects, and understanding the costs associated with these projects can help them improve decision making. PowerPlan’s ability to track costs at the most granular level delivers this insight, helping them realize significant savings.

4 of the Top 5 Public Railroads Trust PowerPlan

“We have reduced our property taxes by 30% through better automation and visibility across all of our tax jurisdictions.”

VP Tax, Railroad

Trusted by Leading Businesses

99%

US Investor-owned Utilities use PowerPlan

PowerPlan helps some of the most complex regulated companies meet mission-critical financial accounting requirements.

$4T

Customer PPE in PowerPlan

PowerPlan’s purpose-built solutions for asset intensive companies are designed to help our customers optimize financial decisions across the enterprise capital lifecycle.

200+

Asset Intensive Customers

PowerPlan helps more than 200 companies find the clarity they need to be confident in their asset management decisions.