Empowering companies

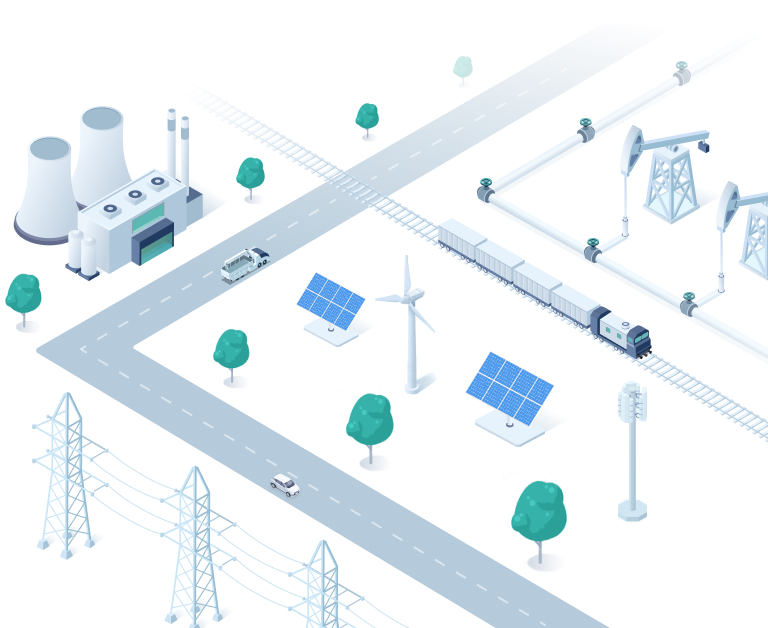

that power the world™

Asset intensive organizations require software that not only stays ahead of accelerating tax and regulatory changes, but optimizes compliance, strategic decision making and financial performance. Find out how PowerPlan can help you solve your most complex financial challenges.

Discover NXT

PowerPlan's next-generation platform, backed by 30 years of industry expertise - now powered by AI

New Tax Webinar

Tax in Transition: Preparing Now For Changes on the Horizon

New Case Study

Learn how WGL is preparing for tax rate changes this year.

Unlock the full financial power of your assets

More than a financial solution, PowerPlan is a powerful system that enables companies to combine granular financial and operational asset data from every corner of the organization into a unique view for each stakeholder, enabling not just the creation of optimized departmental strategies but for the entire organization.- Mitigate compliance risk by applying complex tax and industry specific regulatory requirements to your consolidated, auditable set of financial books.

- Develop defensible, strategic financial asset scenarios that enable optimal planning for today, tomorrow and the next 20+ years.

- Efficiently adopt new business strategies, industry requirements and materially improve cash and earnings.

Executive

Executive

Executives can access the accurate and detailed asset financial information they need to monitor results, make strategic decisions, evaluate new strategies, and implement them efficiently in the way that will optimize financial and customer outcomes. Regulatory

Regulatory

Regulatory teams can streamline and automate regulatory processes and reporting to help strengthen their credibility with regulators, enabling easy evaluation and adoption of new strategies and requirements to drive optimal cost recovery. Tax

Tax

PowerPlan provides tax teams with the tools they need to eliminate manual processes, optimize tax strategies and minimize tax liabilities with confidence. Accounting

Accounting

Accounting teams can get the information they need to maximize cash flow and confidently support compliance, while achieving the scale and flexibility to adapt to new regulations and business objectives efficiently. FP&A

FP&A

With integrated asset cost data and automation tools across the budgeting, forecasting and planning time horizons, FP&A teams can seamlessly support corporate planning and scenario evaluation work; ultimately driving better, more predictable results. Operations

Operations

Operational teams are freed from onerous accounting, tax and regulatory requirements by letting PowerPlan apply optimal strategies to their native work information in a way that optimizes financial outcomes, providing rich cost data to optimize project work and execution.Did you know ...

PowerPlan’s purpose-built solutions for asset intensive companies are designed to help our customers optimize financial decisions across the enterprise capital lifecycle.

PowerPlan helps more than 200 companies find the clarity they need to be confident in their asset management decisions.

PowerPlan helps some of the most complex regulated companies meet mission-critical financial accounting requirements.

Our team focuses on one thing. Your success.

Not the traditional customer support team

We have a Customer Operations team, made up of highly experienced professionals who will work closely with your team to help you get the most from every solution.

Customized training and education

We offer onsite, instructor-led virtual and self-directed online learning methods that cover a spectrum of topics on PowerPlan systems and financial operations within the industries we serve.

A professional community & advisory board

Social Power, our online community, lets you connect with other users and the PowerPlan team to learn about our solutions, share information, find answers and more.

Trusted by industry leaders

Home

Home